Wall Street is showing a dramatic shift in market behavior as investors hit the sell button across a wide range of stocks, not because of earnings or macro data, but out of fear that artificial intelligence (AI) could upend entire industries. This “AI risk-off trade” has led to rapid stock declines, especially in companies perceived as vulnerable to AI competition. Here’s an in-depth look at what’s happening, which stocks are getting hit, why traders are suddenly skittish, and what it could mean for your portfolio.

Why Wall Street Is Suddenly Selling Stocks

The latest market moves reflect an unusual pattern. Investors are dumping stocks not based on fundamentals, but on future disruption risk from AI. Traders increasingly fear AI products, especially from startups, could replace traditional business models faster than companies can adapt. You can read the full breakdown of this trend on Yahoo Finance.

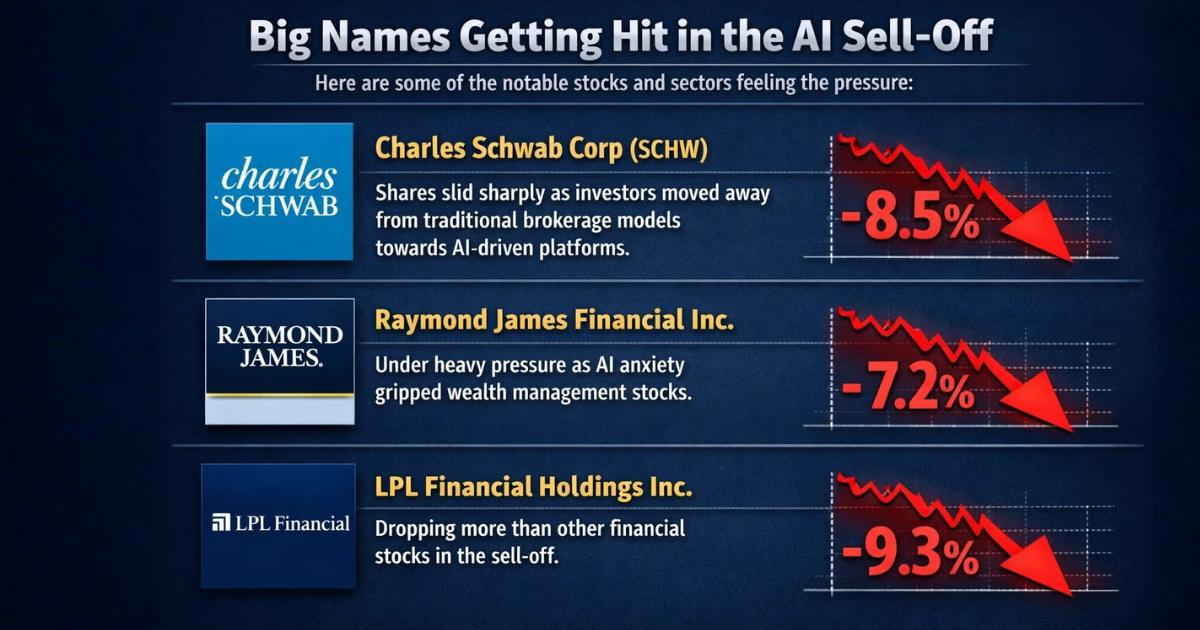

The catalyst? A new AI-driven tax strategy tool launched by Altruist Corp., which spooked Wall Street. Major financial firms like Charles Schwab Corp., Raymond James Financial Inc., and LPL Financial Holdings Inc. saw stock prices plunge more than 7% following the launch, one of the steepest drops in recent sessions.

Investors aren’t just selling tech stocks anymore. They’re dumping shares of financial and service companies simply because AI could automate parts of their business. As one market veteran put it, stocks with any perceived risk of AI disruption are now being sold off indiscriminately. For more context on AI-driven sell-offs, see the guide on yield curves and market indicators.

If you’re wondering why the AI sell-off could actually present an opportunity for investors, Yahoo Finance breaks it down clearly in this video analysis:

Big Names Getting Hit in the AI Sell‑Off

Here are some of the notable stocks and sectors feeling the pressure:

- Charles Schwab Corp (SCHW): Shares slid sharply as investors repositioned away from traditional brokerage models in favor of digital, AI-driven platforms.

- Raymond James Financial Inc.: Also experienced heavy pressure as AI‑related anxiety spread through wealth management stocks.

- LPL Financial Holdings Inc.: Another wealth management player caught in the sell‑off, declining more than other financial stocks.

This sell-off has also spilled into European financial firms and wealth managers, showing that traders are now pricing AI disruption into global markets, not just U.S. stocks. See our in-depth guide DeFi & Derivative Trading 2026, for strategies on 2026 trading trends and market readiness.

What’s Driving the Fear Trade?

Several factors are contributing to this risk‑off behavior:

1. AI Products as Competitors, Not Just Tools

In the past, investors viewed AI as something that could improve business performance. Now, they worry AI could replace entire revenue streams. Startup AI tools have begun entering real commercial spaces, and that’s making Wall Street nervous.

2. Quick Selling Instead of Fundamental Analysis

Investors aren’t taking the time to evaluate fundamentals like earnings or balance sheets. Instead, stocks with even slight disruption risk are being sold first and questioned later a sharp departure from traditional market behavior.

3. Broadening Market Impact

What began as a tech sell-off has spun into a broader financial market move. Stocks once seen as stable now feel pressure from potential automation and tech competition. Are you looking for insight into this year’s larger market changes? For background information on global risk-off behavior, see Asian Markets Slide as Silver Hits. For a deeper look at what triggered the recent AI stock sell-off and how markets are reacting, this detailed breakdown explains the broader market sentiment and risk-off movement:

Market Implications for Investors

This AI‑driven sell‑off highlights key trends you should watch:

- Short‑term volatility may continue: Fear‑based trading can rapidly move prices regardless of company fundamentals.

- AI adaptation will become an investment theme: Winners may be those integrating AI, not those resisting change.

- Risk management is crucial: Diversification and defensive positioning may offer shelter during erratic flows.

Investors who react based on fundamentals, not fear, could find opportunities even in volatility. See our blog post on the Bitcoin Falls Below $92,000 update for suggestions on tactical positioning based on the mood of the market.

Fear, AI, and the Future of Markets

The latest sell-off is less about earnings and more about perception, specifically, how fast AI can disrupt traditional business models. Traders are now pricing future risk into today’s valuations, creating a market where perception often moves before fundamentals. Whether this represents a long‑term trend or just short-term fear, one thing is clear;AI is reshaping investor behavior. Therefore, understanding how to navigate this new landscape will be critical for smart investing in the years ahead. Read more on Yahoo Finance about the latest market developments.

Stay Ahead in the AI Era with FinanceCurves

The market is evolving fast, and AI is reshaping how investors approach stocks. Don’t get left behind, stay informed, make smarter trades, and navigate market volatility confidently. Explore more insights, analysis, and trading strategies on FinanceCurves, and be the first to know about the latest market trends. Your next smart move starts here.

Marshall Mason is a senior market analyst at FinanceCurves.com, leading the finance news and trends category with expert coverage of crypto and financial markets. He tracks real-time market movements, price fluctuations, data-driven trends, and breaking updates across digital assets and global finance. With a strong analytical approach, Marshall translates complex market data into clear insights, helping readers understand market ups and downs, volatility patterns, and the forces shaping today’s crypto and financial landscapes.