Palantir Technologies (PLTR stock) is making waves in the market after its blowout Q4 2025 earnings. The company, a leader in AI-powered data analytics, surpassed Wall Street expectations with strong revenue growth, sending its Palantir stock price climbing. Investors and analysts alike are taking notice, praising Palantir for its innovative AI solutions and robust commercial expansion.

Unlike other tech firms, Palantir combines government and commercial contracts with cutting-edge AI platforms like Gotham and Foundry, making it a rare stock that blends stability with high growth potential. As 2026 unfolds, PLTR stock is becoming a key name in the AI and data analytics landscape.

PLTR Q4 Earnings: The Numbers That Matter

Palantir’s Q4 earnings were impressive, with revenue exceeding Wall Street estimates. According to Yahoo Finance, the company reported $580 million in quarterly revenue, marking a 32% year-over-year growth, while EPS of $0.12 beat the projected $0.08.

A major driver of this growth was Palantir’s commercial client base, which contributed more than 40% of total revenue for the first time. While government contracts remain a strong foundation, expansion into commercial markets is diversifying PLTR’s revenue stream and strengthening its long-term potential. According to the Palantir stock quote and performance on Yahoo Finance, PLTR has seen strong gains year‑over‑year, with its Palantir stock price reflecting increased investor interest following the company’s latest earnings announcements

Insights: Most competitors focus only on headline earnings. Highlighting the shift toward commercial clients demonstrates Palantir’s technology and strategic positioning for sustainable growth.

Why Investors Are Excited About Palantir

The excitement around the Palantir stock chart is not just about Q4 numbers; it’s about AI adoption. Palantir’s platforms, including Foundry for enterprise analytics and Gotham for defense and government intelligence, are increasingly in demand.

Analysts note that Palantir’s AI solutions help clients make faster, data-driven decisions, which is increasingly a must-have in sectors such as healthcare, finance, and defense. StockTwits reported that analysts upgraded PLTR, citing its AI leadership and potential international expansion.

Insights: Beyond government reliance, Palantir’s AI-focused strategy positions it to capture new markets globally. Broader market trends, such as Asian markets sliding, can influence tech stocks like Palantir and should be considered by investors.

PLTR Stock Price & Market Reaction

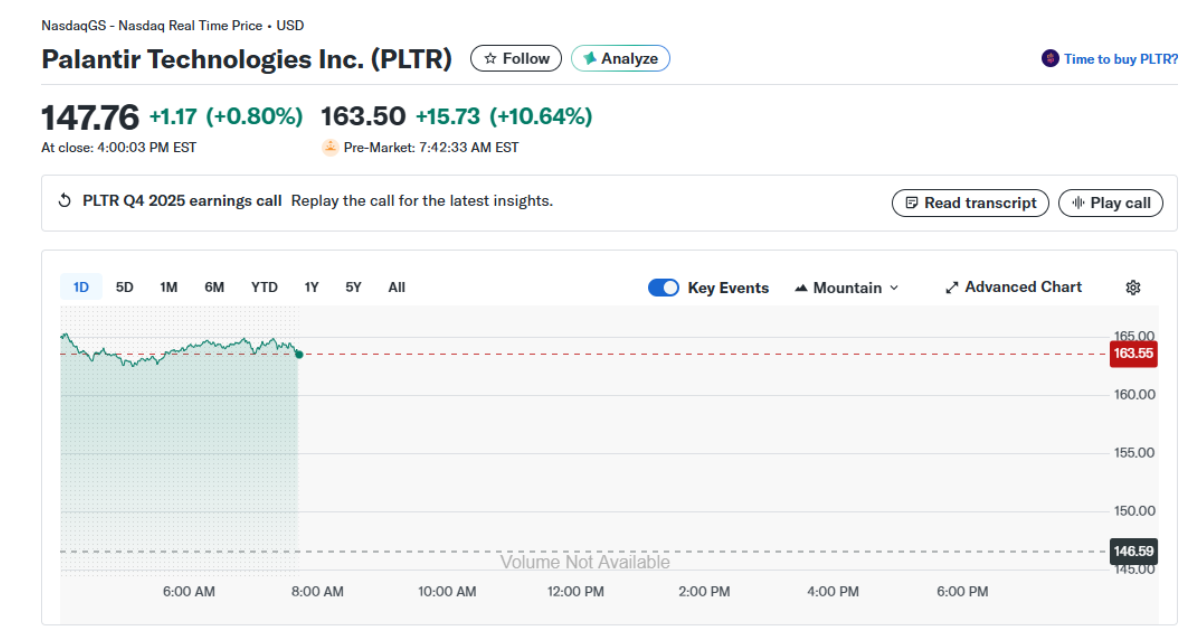

Following the earnings announcement, PLTR stock price surged by 8% in after-hours trading, reflecting investor confidence in the company’s growth trajectory. Over the past 12 months, Palantir has outperformed many tech peers, especially in the AI-focused sector. Over the past 12 months, Palantir has outperformed many tech peers, especially in the AI-focused sector, according to Palantir stock performance data.

Comparisons with other AI stocks, such as NVIDIA and C3.ai, show that while PLTR may have a smaller market cap, its unique combination of AI and government contracts offers a more stable growth outlook. High trading volumes indicate strong retail and institutional investor interest, reinforcing PLTR stock’s rising market influence. Check out the MarketWatch report on PLTR stock surge

Risks and Considerations

While Palantir shows promise, potential investors should consider several risks:

- Valuation Concerns: PLTR stock trades at a premium relative to traditional data analytics firms.

- Government Contract Dependence: A significant portion of revenue still comes from U.S. government contracts.

- Competition: Other AI-driven analytics platforms are emerging rapidly.

Unique Insight: Many articles ignore valuation vs. AI growth potential. Highlighting this helps investors balance optimism with caution.Investors should also be mindful of market volatility when trading high-growth tech stocks like PLTR, similar to what we’ve seen with tracking volatile assets like Bitcoin.

Why Palantir Could Lead AI-Driven Data Analytics

Palantir is uniquely positioned to lead the AI analytics revolution:

- Expansion into new sectors like healthcare and finance.

- International contracts could add substantial revenue.

- Continued platform innovation ensures clients remain dependent on Palantir for data insights.

External analysts suggest that if commercial revenue continues to rise, Palantir could sustain 20–30% annual growth over the next few years. External analysts suggest that if commercial revenue continues to rise, Palantir could sustain 20–30% annual growth over the next few years detailed Palantir earnings review

Why PLTR Stock Is One to Watch in 2026

Palantir’s Q4 2025 earnings showcase strong revenue growth, growing commercial adoption, and its leadership in AI-powered analytics. While challenges like competition and valuation exist, the company’s innovation and global expansion make it a standout in the tech sector.

For investors, tech enthusiasts, and market watchers looking for real-time insights on Palantir stock, PLTR earnings, and trending stocks, FinanceCurves is your go-to source for actionable financial news and analysis. Stay ahead of the market and track PLTR stock as it continues to shape the future of AI data analytics.

Sloane Holt is a stock market and financial markets writer at FinanceCurves.com, specializing in the Stock Exchange category. She covers market movements, price fluctuations, trading activity, and key financial updates across global exchanges. With a strong focus on data, trends, and market behavior, Sloane delivers clear and timely insights that help readers understand stock performance, market volatility, and the factors influencing daily and long-term market direction.