Are you tired of wondering where your money goes every month? You’re not alone. Most people overspend, forget to save, and end up stressed about money. But there’s a budgeting method that can change that: a zero-based budget.

A zero-based budget makes sure every dollar you earn has a job. Whether it’s for bills, savings, debt, or fun, that way, you stop wasting money and start planning your financial life with purpose. In this guide, you’ll learn exactly how to create a zero-based budget that actually works for you. Check out step-by-step instructions with real examples and useful tools.

What Is a Zero‑Based Budget?

Fundamentally, a zero-based budget entails allocating each dollar of income before it is spent.

Your goal is this equation:

Income − Allocated Dollars = 0

In other words, every dollar is planned for; none is left “floating” or unassigned. This strategy forces you to justify every expense from scratch instead of guessing or carrying over last month’s habits. Learn more about the concept of zero-based budgeting from Investopedia.

Quick Example of a Zero-Based Budget:

If your monthly income is $3,000, then your total planned spending, savings, and debt payments should also equal $3,000, with no leftovers.

Why Zero‑Based Budgeting Works (and What Makes It Better)

A zero-based budget works because it forces intentional spending:

- Every dollar has a purpose; nothing is left unplanned.

- You stay in control of your money instead of letting it slip away.

- Great for saving, debt payoff, and financial goals.

Experts note that zero-based budgeting can help spot unnecessary costs and redirect money toward what matters most. Check out insights on zero-based budgeting and financial efficiency from IBM.

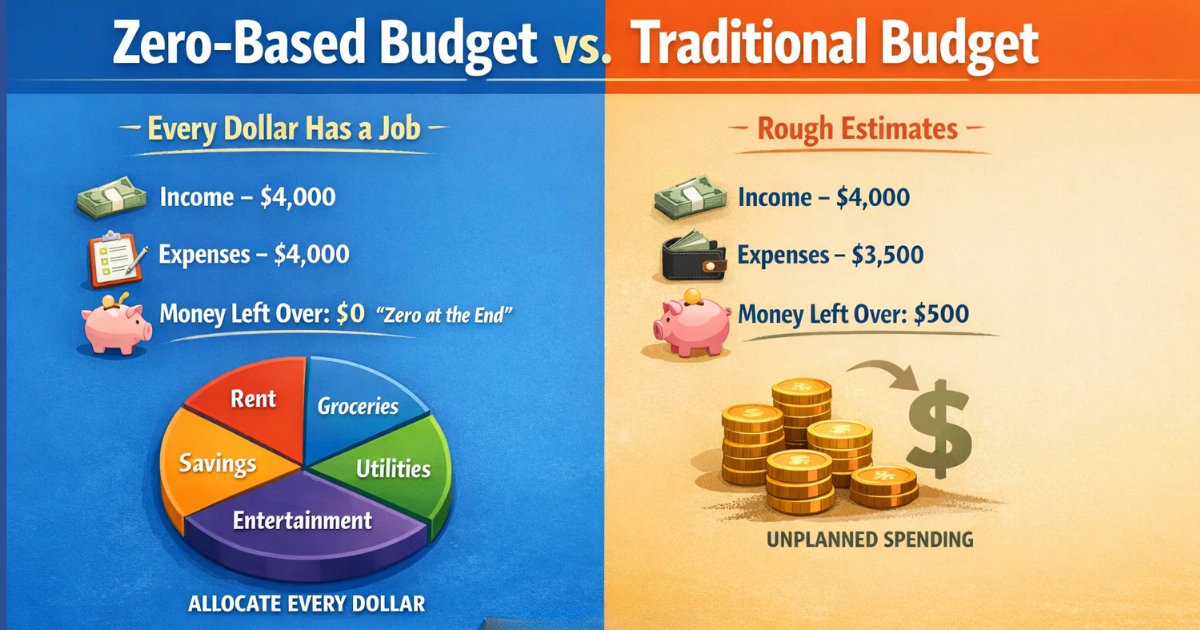

Zero‑Based Budget vs Traditional Budget

Not all budgets are created equal. Understanding the difference between a zero-based budget and a traditional approach will help you choose the method that actually keeps your money working for you.

| Feature | Zero‑Based Budget | Traditional Budget |

| Starting point | Starts from zero each period | Uses last period’s numbers |

| Expense review | Every item is justified | Only new changes are reviewed |

| Purpose | Assign money to goals | Track past spending |

| Best for | Intentional, goal‑oriented budgeting | Simple tracking |

Zero-based budgeting forces you to justify each expense every new month. Traditional budgeting tends to roll forward without questioning each item. If you want to explore more about financial stability and tools that can complement your budget, check out what stablecoins are and their role.

Step‑by‑Step: How to Create a Zero‑Based Budget That Actually Works

Creating a zero-based budget is easier than it sounds. With a clear plan, you can assign every dollar a purpose and take control of your finances.

Let’s break it down into easy and actionable steps.

-

Calculate Your Actual Monthly Income

Include all earnings after taxes (salary, freelance, and side gigs). This is the total amount you will distribute.

Tip: Only budget money you already have, not future expected income. This keeps the budget realistic. For more ideas on allocating money wisely, see Top Cash Stock to Watch in 2026.

-

List All Monthly Expenses

Create categories that start with essentials like

- Rent/mortgage

- Utilities

- Groceries

- Transportation

- Insurance

Then add flexible categories like

- Eating out

- Entertainment

- Subscriptions

This is the core of a step-by-step zero-based budgeting guide that ensures every dollar has a purpose.

-

Assign Every Dollar a Job

This is where the magic happens: assign your income to each category so that your total equals your income.

Example of a monthly budget plan that works:

| Category | Budgeted Amount |

| Rent | $900 |

| Utilities | $150 |

| Groceries | $350 |

| Savings | $400 |

| Debt Payments | $300 |

| Transportation | $200 |

| Fun & Misc | $300 |

| Total | $3,000 |

-

Prioritize Savings and Debt Repayment

After essentials, focus on:

- Emergency fund

- Retirement contributions

- Paying down high-interest debt

This is where many budgets fail; don’t leave these to the end. Treat them like bills.

-

Track Actual Spending Throughout the Month

A zero-based budget isn’t “set it and forget it.” You MUST track actual spending and adjust as needed. Check in weekly and update your budget:

- Did you overspend on groceries?

- Have extra entertainment?

Tools like budgeting apps and spreadsheets can make this process easier and keep your plan accurate.

- Adjust at the End of the Month

At the month’s end, reconcile what you planned vs. what you spent. Then update next month’s budget. This is how you improve your zero-based budgeting for beginners and make it actually work.

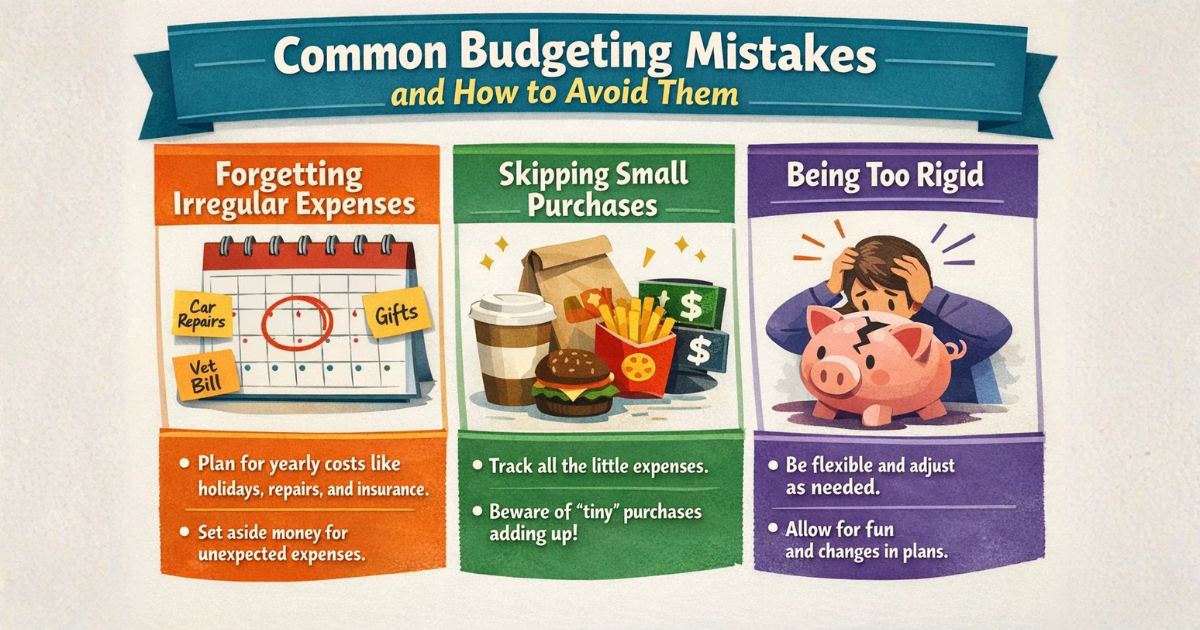

Common Mistakes and How to Avoid Them

Even the best budgets can go off track. Being aware of common pitfalls will help you stay consistent and make your zero-based budget truly effective.

Forgetting Irregular Expenses

Not every bill is monthly; things like car maintenance, gifts, or annual subscriptions matter too.

Solution: Create a “sinking fund” category to save gradually.

Skipping Small Purchases

Small spending adds up fast.

Solution: Track every purchase, even coffee. It shows real spending habits.

Being Too Rigid

If your budget feels impossible, you’ll quit.

Solution: Be willing to move dollars between categories; it’s part of a healthy budget.

Take Charge of Every Dollar

A zero-based budget isn’t just another budgeting trend; it’s a financial system that makes money intentional. By allocating every dollar to a job, you gain clarity, control, and real progress toward your goals.

Whether you’re saving for an emergency fund, paying down debt, or just trying to stop overspending, zero-based budgeting gives you a working plan instead of guessing where your money went.

Start today: calculate your income, list your expenses, assign every dollar a job, and watch your financial confidence grow.

Ready to take control of your finances? Download a free zero-based budget template and begin your step-by-step budgeting journey now.

Stay connected with FinanceCurves for more personal finance tips and insights!

FAQs

What’s the difference between zero‑based budgeting and other budgeting methods?

A zero‑based budget starts from zero each period and justifies every expense, unlike traditional budgets that adjust from past months.

Do I need to track every penny?

Yes! Your budget only works if you track actual spending and update your plan. Small purchases matter.

Is zero‑based budgeting only for people with predictable income?

No! It can work for irregular income, but you may need a buffer category to handle fluctuations.

How often should I update my budget?

Ideally, weekly or monthly—adjusting as you go improves accuracy.

Can this budgeting method help me save more money?

Yes, because you prioritize savings early rather than as an afterthought.

Marshall Mason is a senior market analyst at FinanceCurves.com, leading the finance news and trends category with expert coverage of crypto and financial markets. He tracks real-time market movements, price fluctuations, data-driven trends, and breaking updates across digital assets and global finance. With a strong analytical approach, Marshall translates complex market data into clear insights, helping readers understand market ups and downs, volatility patterns, and the forces shaping today’s crypto and financial landscapes.