Grayscale has just crossed a major milestone in crypto investing, and it could change how Ethereum ETFs work in the U.S. forever.

On Monday, the digital asset giant made the first-ever distribution of Ethereum staking rewards to shareholders of a U.S. spot crypto exchange-traded product. For the first time, a regulated Ethereum ETF isn’t just tracking price; it’s paying protocol-level income.

What Investors Are Getting

The distribution covers staking rewards earned between October 6, 2025, and December 31, 2025. Shareholders of Grayscale’s Ethereum Trust (ETHE) will receive $0.083178 per share, payable on Tuesday to investors who held shares as of January 5.

This move marks a turning point: Ethereum ETFs are no longer passive price trackers—they’re starting to reflect how the Ethereum network actually works.

Why This Is a Big Deal

Until now, staking rewards have been absent from U.S. spot crypto ETFs due to regulatory uncertainty. That meant investors were exposed to Ethereum’s price—but not one of its core economic benefits.

Grayscale’s decision changes that narrative.

By distributing staking rewards, the firm is effectively expanding the ETF model to include real network income, all while operating under the Securities Act of 1933.

“This isn’t just a win for Grayscale,” CEO Peter Mintzberg said, adding that the move benefits “the entire Ethereum community and ETPs at large.”

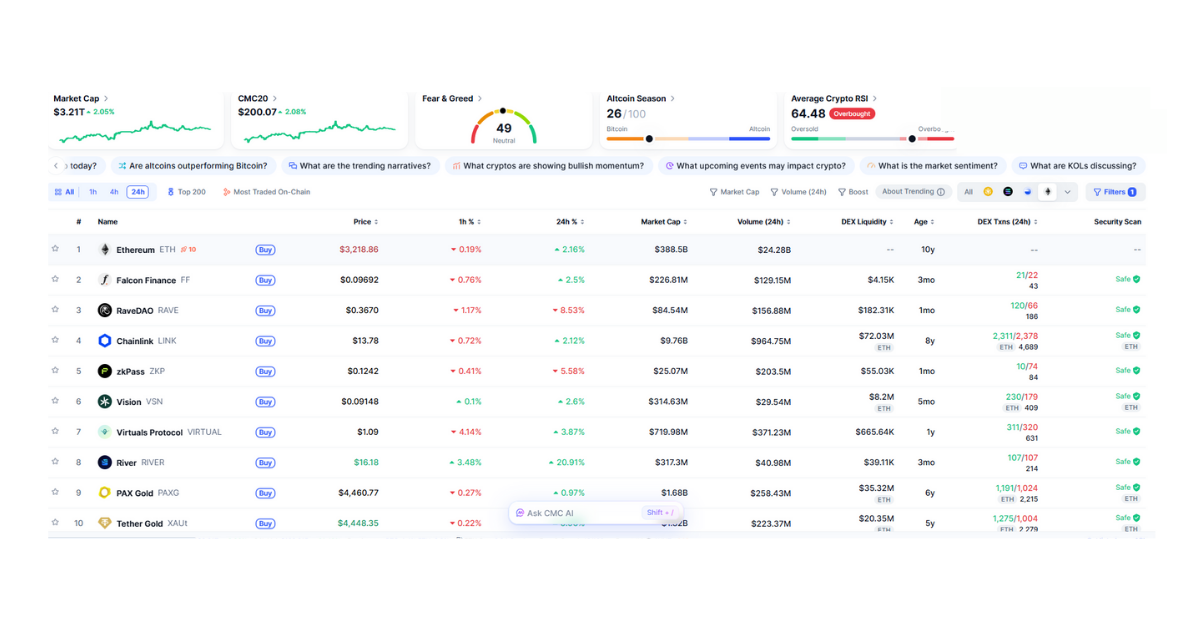

Credit: CoinMarketCap

How We Got Here

Back in October, Grayscale became the first U.S. issuer to enable staking within its Ethereum exchange-traded products, allowing ETHE and related vehicles to earn rewards directly from the network.

A month later, regulatory clarity followed.

New guidance from the U.S. Treasury and IRS outlined how staking rewards could be handled from both a tax and regulatory standpoint. That guidance created what Treasury Secretary Scott Bessent called a “Clear Path” for crypto ETPs to stake assets like Ethereum and Solana and pass rewards on to retail investors.

Testing the Limits of ETF Design

Traditionally, U.S. spot crypto ETFs were intentionally designed to avoid interacting with blockchain functions like staking. That structure helped issuers stay within existing securities rules but at the cost of limiting investor upside.

The Securities Act of 1933 focuses on disclosure and transparency during the offering process. It doesn’t dictate how funds must generate returns over time. Grayscale is now testing whether staking income can fit inside that framework without triggering stricter investment company regulations.

If successful, this could open the door for:

- Yield-generating Ethereum ETFs

- More accurate representations of proof-of-stake economics

- Greater institutional and retail interest in on-chain rewards

What This Means for Ethereum ETFs

Grayscale’s move signals a shift toward next-generation crypto ETFs, products that don’t just mirror price charts but participate in the networks they represent.

For investors, that means potential yield on top of price appreciation. For the broader market, it could set a precedent that other issuers rush to follow.

At FinanceCurves, we’re watching this closely. If staking rewards become standard across Ethereum ETFs, it could redefine how regulated crypto exposure works in 2026 and beyond.

Charles Cooper is a cryptocurrency analyst and digital finance writer at FinanceCurves.com, specializing in the Cryptocurrency category. He covers Bitcoin, altcoins, blockchain trends, and crypto market movements with a strong focus on data, price action, and market sentiment. Charles delivers clear, research-driven insights that help readers understand crypto volatility, emerging opportunities, and the broader forces shaping the digital asset ecosystem.