Bitcoin has evolved from a fringe technology experiment into a mainstream financial asset. Whether you’re curious about your first crypto purchase or looking to diversify your portfolio, understanding how to buy Bitcoin safely in the USA has never been more important. Bitcoin recently hit an all-time high above $126,000 in October 2025, though it’s currently trading around $69,000 as of February 10, 2026. This volatility is normal, and it’s exactly why education matters more than hype.

What Is Bitcoin, Really?

Think of Bitcoin as digital money that no single person, company, or government controls. Instead of being stored in a bank vault, Bitcoin lives on a blockchain—essentially a shared digital ledger that thousands of computers around the world maintain simultaneously.

Here’s what makes it different: when you buy Bitcoin through an exchange like Coinbase or Kraken, that transaction gets recorded permanently on the blockchain. Anyone can verify it happened, but your personal identity stays protected. This transparency, combined with privacy, is what attracts many people to cryptocurrency.

The blockchain isn’t just a fancy database. It’s the foundation of decentralized finance (DeFi), where you can control your own money without intermediaries. No bank can freeze your Bitcoin. No government can inflate it away. There will only ever be 21 million bitcoins, and we’re already at about 20 million in circulation. Everything beginners need to know about blockchain is covered in this simple explanation.

Why the USA Is Bitcoin’s Biggest Market

The United States leads the world in cryptocurrency adoption. Here’s what makes 2025-2026 special:

Regulatory Clarity: The SEC launched its Crypto Task Force in January 2025, shifting from “regulation by enforcement” to clear rules. The GENIUS Act established federal oversight for stablecoins, and the CLARITY Act aims to distinguish digital commodities from securities.

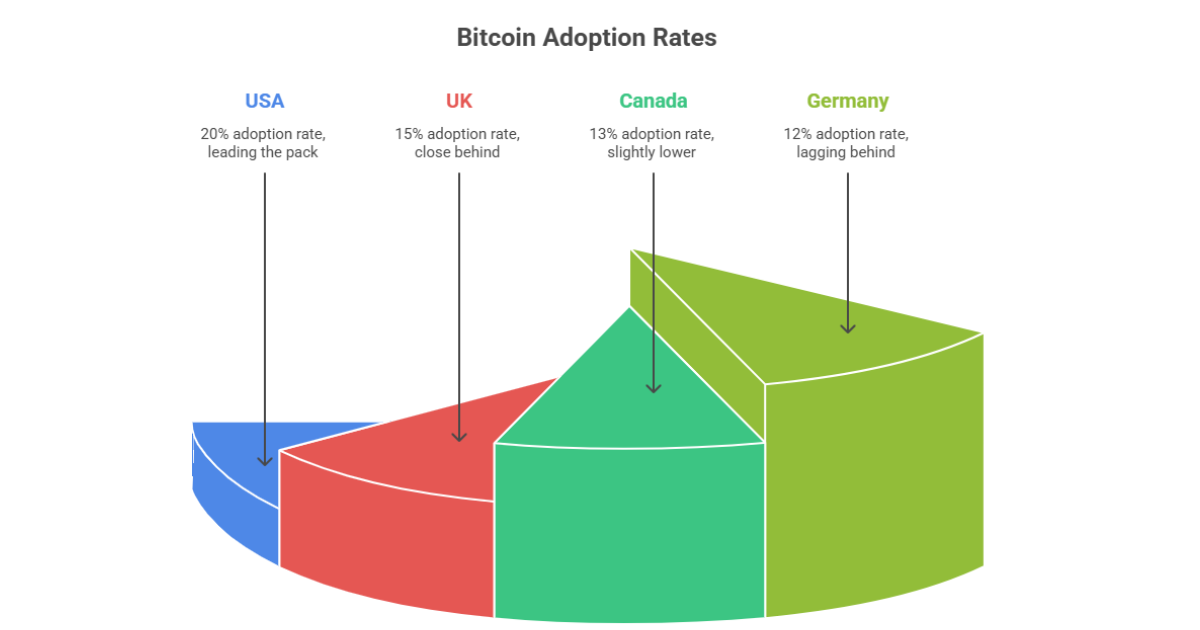

Market Size: Roughly 46 million Americans now own cryptocurrency—about 20% of adults. US exchanges process over $200 billion monthly, making America dominant in global crypto markets.

The SEC’s approval of Bitcoin ETFs in early 2025 was a game-changer, allowing traditional investors to get Bitcoin exposure through regular brokerage accounts.

US Bitcoin Market Stats (2026)

| Metric | Data | Source |

| Bitcoin Users in the USA | ~46 million | Statista |

| % of Americans Owning Crypto | 20% | Pew Research |

| US Exchange Trading Volume | $200+ billion/month | CoinMarketCap |

| Global Bitcoin Market Cap | $1.36 trillion | CoinMarketCap |

| Current Bitcoin Price | $69,422 | Real-time (Feb 10, 2026) |

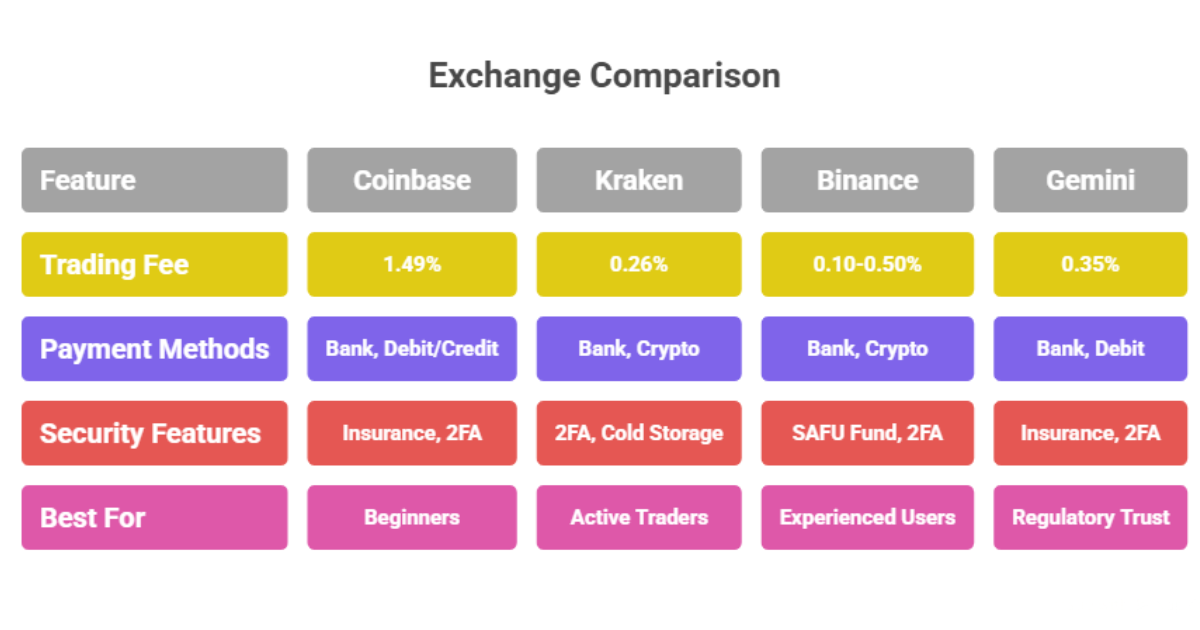

Choosing Your Exchange: More Important Than You Think

Not all crypto exchanges are created equal. Your exchange is where you’ll buy, sell, and potentially store your Bitcoin, so this decision matters.

Top US Crypto Exchanges Comparison

| Exchange | Trading Fee | Payment Methods | Security Features | Best For |

| Coinbase | 1.49% | Bank, Debit/Credit | Insurance, 2FA | Beginners |

| Kraken | 0.26% | Bank, Crypto | 2FA, Cold Storage | Active Traders |

| Binance | 0.10-0.50% | Bank, Crypto | SAFU Fund, 2FA | Experienced Users |

| Gemini | 0.35% | Bank, Debit | Insurance, 2FA | Regulatory Trust |

Coinbase is ideal for beginners thanks to its simple interface and insurance protection, even though its 1.49% fees are higher than competitors.

Kraken suits active traders with low 0.26% fees, strong regulatory compliance, and a long security track record — it has never been hacked since 2011.

Binance appeals to experienced users by offering some of the lowest fees (0.10–0.50%), though its advanced tools can feel overwhelming for newcomers.

Gemini stands out for investors who prioritize trust and regulation, emphasizing compliance and full insurance coverage for added peace of mind.

All major US exchanges follow SEC and FinCEN guidelines with mandatory Know Your Customer (KYC) procedures requiring government ID verification. Find the safest crypto trading platforms.

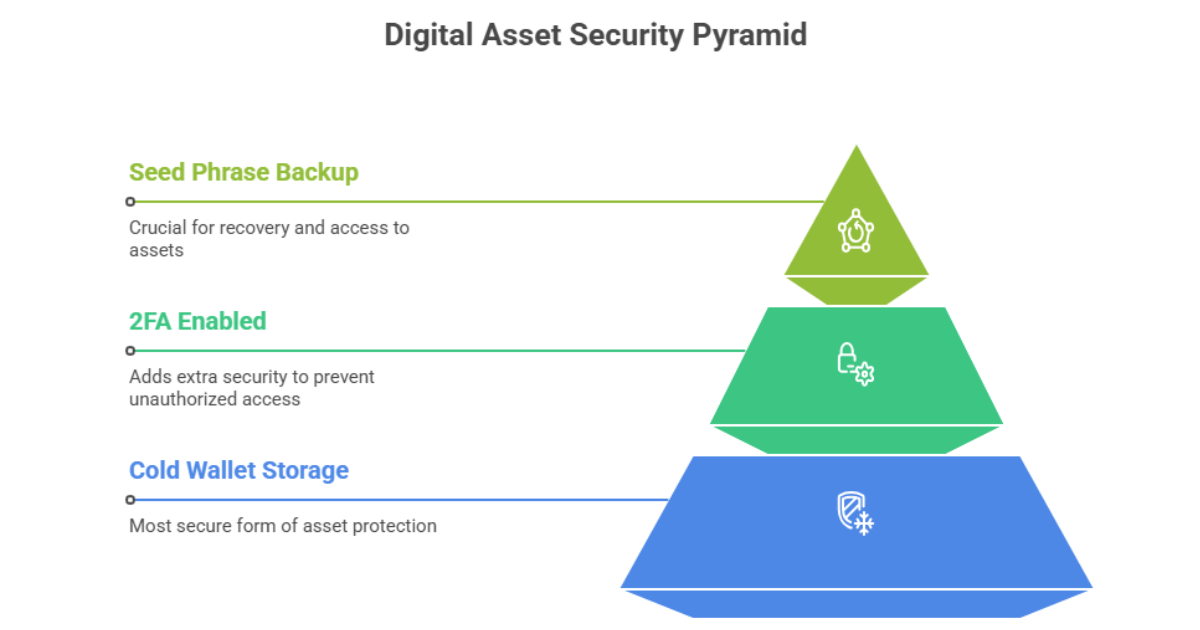

Wallet Security: Protecting Your Investment

Buying Bitcoin is easy. Keeping it safe requires effort.

Hot Wallets stay connected to the internet. Apps like MetaMask or Trust Wallet offer convenience for frequent trading, but they’re vulnerable to hacking if your device is compromised.

Cold Wallets are offline hardware devices. Ledger and Trezor are industry leaders, working like ultra-secure USB drives for cryptocurrency. Your Bitcoin stays disconnected from the internet, making remote hacking nearly impossible.

If you’re investing more than $500, buy a cold wallet. The $100-150 expense beats watching thousands vanish from a hack.

Write down your seed phrase on actual paper and store it safely—not on your computer or phone. Lose those words, and your Bitcoin is gone forever.

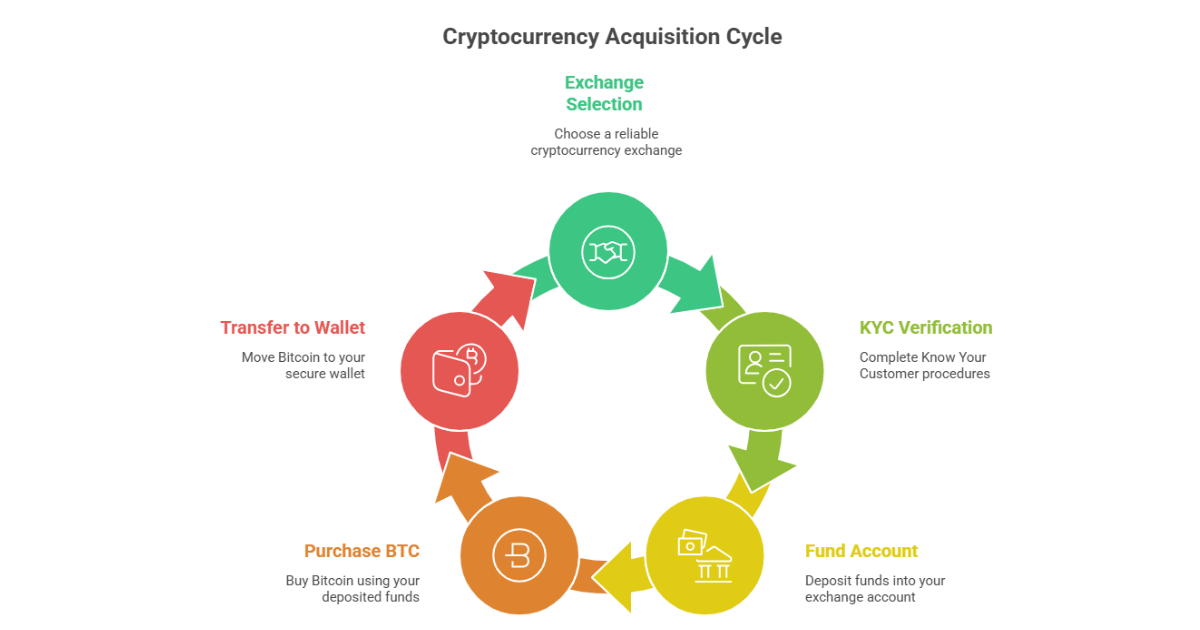

How to Actually Buy Bitcoin

Step 1: Choose Your Exchange. Create an account with your email, password, and government-issued ID ready.

Step 2: Verify Your Identity. Upload photos of your driver’s license or passport. This usually takes a few hours to a day.

Step 3: Add Payment Link to your bank account, debit, or credit card. Bank transfers offer the lowest fees but take 3-5 days. Cards are instant but cost 3-4%.

Step 4: Make Your Purchase Start small—invest $50-200 to learn the system. Place a market order (buy immediately) or a limit order (buy at your target price).

Step 5: Secure Your Bitcoin. For amounts under $500, keeping Bitcoin on a reputable exchange is fine. For larger amounts, transfer to your cold wallet.

Understanding Bitcoin’s Price Swings

Bitcoin isn’t stocks or bonds—it’s a completely different asset class with its own volatility patterns.

Bitcoin Price History (5-Year Overview)

| Year | BTC Price (USD) | Market Event |

| 2021 | $69,000 | All-time high (Nov 2021) |

| 2022 | $16,500 | Crypto winter low |

| 2023 | $42,000 | Recovery begins |

| 2024 | $73,000 | ETF approval rally |

| 2025 | $126,000 | New ATH (Oct 2025) |

| 2026 | $69,422 | Current (Feb 10, 2026) |

Source: CoinMarketCap Historical Data

Recent history shows extreme price movements: Bitcoin crashed from $69,000 to $16,500 during 2022’s crypto winter, then roared back to hit $126,000 in October 2025. Now it’s trading around $69,000—a 45% drop from all-time highs that might sound catastrophic, but is considered normal for Bitcoin.

This volatility attracts traders but can terrify traditional investors. If losing 50% temporarily keeps you awake, Bitcoin might not suit your risk tolerance. Most advisors suggest keeping crypto at 5-10% of total investments—never invest money you’ll need soon.

Beyond Bitcoin: The Altcoin Universe

Bitcoin dominates with roughly 50% of the total cryptocurrency market cap, but other projects serve different purposes:

Top Alternative Cryptocurrencies

| Crypto | Purpose | Market Cap | Use Case |

| Ethereum (ETH) | Smart contracts | $250B | DeFi & dApps |

| Solana (SOL) | Fast blockchain | $35B | Low-cost transactions |

| Cardano (ADA) | Proof-of-stake | $15B | Eco-friendly blockchain |

| XRP | Payment settlement | $80B | Cross-border payments |

Ethereum enables smart contracts and powers most decentralized applications—the fuel of the DeFi ecosystem.

Solana offers fast, cheap transactions and has recovered strongly after the 2022 FTX collapse.

Cardano uses peer-reviewed code for potentially more secure blockchain development.

Diversifying into altcoins can reduce or amplify risk depending on your choices. Research thoroughly.

Check Out: Bitcoin Price Predictions 2026

Key Risks to Consider

Scams Are Everywhere: Fake websites, impersonator accounts, and phishing texts; they’re constant. Never share your seed phrase with anyone, ever.

Regulatory Changes: While 2025 brought clarity, regulations keep evolving and could impact exchanges or taxes.

Tax Implications: The IRS treats crypto as property. Every trade is a taxable event. Keep detailed records.

Exchange Risk: Even regulated exchanges can fail. Keep large amounts in cold storage, not on exchanges.

Infographic Idea: Risk assessment scale showing Low → Medium → High risks with icons for each category

Starting Your Bitcoin Journey

Start with education before investment. Use only money you can afford to lose while learning. Enable two-factor authentication everywhere. Write down your seed phrases. And ignore the hype cycles, focus on long-term understanding.

Bitcoin isn’t a get-rich-quick scheme. It’s a technology that is gradually changing how we think about money. Whether it succeeds long-term remains uncertain, but understanding it has become essential financial literacy. At FinanceCurves, we provide honest, research-based guidance on cryptocurrency and blockchain. The market changes daily, but smart investing principles stay constant: educate yourself, start small, and never risk more than you can afford to lose.

FAQs

Is Bitcoin safe for beginners?

Yes, if you use regulated exchanges like Coinbase and store Bitcoin in secure wallets.

How much should I invest initially?

Start with $50-$500 to learn the system without significant risk.

What’s the best wallet for US investors?

Ledger and Trezor (cold wallets) for security; MetaMask for convenience.

Can I buy Bitcoin with a debit card?

Yes, most US exchanges accept debit/credit cards with instant processing.

Are crypto exchanges regulated in the USA?

Yes, they follow SEC and FinCEN guidelines with mandatory KYC procedures.

How do I protect Bitcoin from hackers?

Use cold wallets, enable 2FA, backup your seed phrase, and never share it.

Which altcoins should I consider?

Ethereum, Solana, and Cardano are popular for portfolio diversification.

What are the tax implications?

The IRS treats crypto as property; every trade is a taxable event.

How volatile is Bitcoin?

Extremely—it can swing 20-50% in weeks; only invest what you can afford to lose.

Where can I learn more about crypto?

Start with FinanceCurves guides, Coinbase Learn, and official SEC resources.

Disclaimer: This article is for educational purposes only. Cryptocurrency investments carry substantial risk, including total loss of capital. Conduct your own research and consult a qualified financial advisor before investing.

Charles Cooper is a cryptocurrency analyst and digital finance writer at FinanceCurves.com, specializing in the Cryptocurrency category. He covers Bitcoin, altcoins, blockchain trends, and crypto market movements with a strong focus on data, price action, and market sentiment. Charles delivers clear, research-driven insights that help readers understand crypto volatility, emerging opportunities, and the broader forces shaping the digital asset ecosystem.