The financial landscape of February 2026 looks nothing like the markets of a decade ago. As of this week, the S&P 500 is testing the historic 7,000 level, marking a new era of growth driven by the “Big Sector Rotation.” We have moved past the era of “meme stocks” and entered a period defined by AI-driven volatility, shifting global trade deals, and a new interest rate “normal.”

For a beginner, the barrier to entry has never been lower—you can buy fractional shares with the click of a button—but the barrier to success has never been higher due to information overload. This guide is a professional roadmap designed to take you from a curious observer to a disciplined wealth builder in the modern economy.

The Financial Audit: Building Your “Launchpad”

Before you purchase a single share of an ETF or a tech giant like Nvidia, you must ensure your personal finances can handle the “G-force” of market volatility. Investing is the final step of a healthy financial life, not the first.

- Audit Your Cash Flow: You cannot invest what you do not track. To find the “extra” capital for your portfolio, start by learning how to create a zero-based budget that actually works to ensure every dollar has a job.

- The Emergency Buffer: Never invest your rent money. In 2026, the fastest way to lose in the stock market is being forced to sell your shares during a “market correction” because of an unexpected bill.

- Target: 3–6 months of essential living expenses.

- Storage: Many smart investors now use the best zero balance bank accounts to avoid monthly fees while keeping their “just-in-case” cash accessible and liquid.

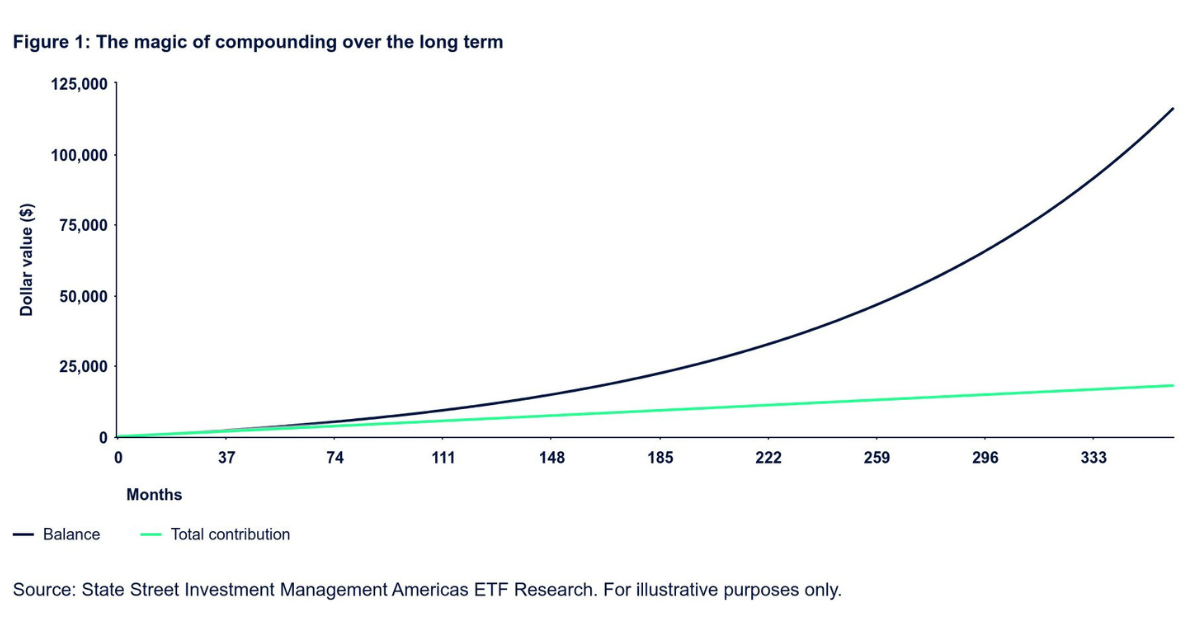

The Mathematics of Wealth: Compound Interest

The reason the stock market is the greatest wealth-building tool in history isn’t because of “lucky picks”—it’s because of Compound Interest. In the 2026 market, where AI tools can execute trades in milliseconds, the only edge a retail investor has left is time.

The standard formula for calculating your future wealth is:

Where:

- A = Final amount.

- P = Initial principal.

- r = Annual interest rate (The S&P Global Index Dashboard shows a historical average of ~10%).

- n = Number of times interest compounds per year.

- t = Number of years.

The “secret sauce” is time ($t$). Waiting just five years to start can result in a six-figure difference in your final portfolio value by the time you reach retirement age.

Picking Your Strategy: Passive vs. Active

Before putting your hard-earned cash at risk, you need to decide how much time you want to spend on research. In 2026, beginners often get distracted by social media “finfluencers” promoting high-risk day trading. To succeed, you must understand investing: what works, what fails, and why, so you don’t fall for “get rich quick” traps.

The Index Fund Strategy (Recommended)

For 90% of beginners, Exchange-Traded Funds (ETFs) are the gold standard. They allow you to buy a “basket” of hundreds of stocks, such as the Vanguard S&P 500 ETF (VOO). This provides instant diversification; if one company fails, the others carry the weight. Check fund details at Vanguard’s Official Portal.

Individual Stock Picking

If you have the time to research, you might choose to buy individual companies like Apple or emerging 2026 energy leaders. However, this requires reading SEC EDGAR filings. If you cannot explain why a company makes money, you are gambling, not investing.

The 5-Step Roadmap for 2026

- Select Your Broker: Choose a platform like Fidelity or Charles Schwab, which offer $0 commissions and fractional shares.

- Maximize Tax-Advantaged Contributions: For 2026, the IRS has increased contribution limits:

- Roth IRA: The limit is now $7,500.

- 401(k): The employee deferral limit has risen to $24,500.

- Tip: Track your IRS direct deposit time to ensure you reinvest your tax refund as soon as it hits.

- Automate Your Deposits: Set up “Dollar-Cost Averaging” (DCA). Invest a fixed amount (e.g., $100) every month, regardless of whether the market is up or down.

- Diversify Across “New Economy” Sectors: Don’t just buy tech. As of February 2026, we are seeing a “Big Rotation” into Energy Transition and Healthcare & Biotech.

- Ignore the Noise: The market is a “weighing machine” in the long term but a “sentiment machine” in the short term. Don’t let daily news dictate your 20-year plan.

Learn More!

The Cost of Inaction

The greatest risk in the 2026 stock market isn’t a crash—it’s inflation eating away at your savings while you sit on the sidelines. The “perfect time” to start does not exist. There is only “today.”

By following this roadmap, you’re not just buying stocks; you’re investing in your future freedom. Ready to take control of your money? Join the FinanceCurves for daily updates, AI-powered financial tools, and the strategies you need to succeed in 2026!

FAQs

How much money do I need to start investing in 2026?

Most modern brokers allow you to begin with as little as $1 thanks to fractional shares, though we recommend a consistent monthly goal of at least $50 to truly benefit from long-term compounding.

Is the stock market basically just a form of gambling?

Unlike gambling, which is a zero-sum game, the stock market is an investment in the growth and productivity of real companies that produce profits for their shareholders.

What is a “Market Correction,” and should I sell my stocks?

A correction is a 10% drop in market prices that occurs about once per year; rather than selling, successful investors view these as “sales” and continue to buy more shares at a lower average cost.

What is the difference between a Stock and an ETF?

A stock represents ownership in a single specific company, while an ETF is a diversified “basket” of many different stocks that allows you to spread your risk across the entire market with one purchase.

How do I avoid paying high taxes on my investment gains?

By using tax-advantaged accounts like a Roth IRA or 401(k), you can either defer your taxes or grow your money entirely tax-free, which can save you a fortune in capital gains taxes over your lifetime.

Sloane Holt is a stock market and financial markets writer at FinanceCurves.com, specializing in the Stock Exchange category. She covers market movements, price fluctuations, trading activity, and key financial updates across global exchanges. With a strong focus on data, trends, and market behavior, Sloane delivers clear and timely insights that help readers understand stock performance, market volatility, and the factors influencing daily and long-term market direction.