the BitcoinThe Bitcoin price has experienced a sharp decline on January 30, 2026, marking one of the most dramatic corrections in recent months. This Bitcoin price drop was triggered by a wave of Bitcoin price liquidations, institutional outflows, and broader risk-off sentiment in traditional markets. Investors and traders are closely watching Bitcoin price today, assessing whether this is a temporary pullback or a deeper Bitcoin price crash.

For insights into potential recovery and projections, see our detailed analysis on Predicting Bitcoin Price — Breakout or Setback?

Bitcoin Price Today: Key Stats

- As per Bloomberg reports, Bitcoin slipped below $84,000, reaching its lowest level in over two months.

- Over $1.7 billion in leveraged positions was liquidated in just 24 hours. (CoinDesk)

- Ether and other major tokens also fell amid heightened volatility, reflecting the broader Bitcoin price sell-off.

For a full breakdown of global market reactions, check our coverage on Dow Jones Futures Climb Ahead of Big Tech Earnings.

Why Bitcoin Price is Falling?

1. Mass Liquidations Fuel the Bitcoin Price Crash

Forced liquidations have been a significant driver of the current Bitcoin price falling scenario. When leveraged positions cannot meet margin requirements, exchanges automatically close them — triggering cascading sell-offs.

CoinDesk notes that the accelerated unwind of leveraged positions pushed Bitcoin and other major cryptocurrencies lower, highlighting the impact of margin trading on Bitcoin price volatility.

2. Institutional Outflows Weigh on Bitcoin Price

Institutional demand remains a critical factor in supporting Bitcoin price today. However, recent data shows that crypto ETF flows have turned negative, signaling declining appetite from large investors. These outflows amplify selling pressure and contribute to the ongoing Bitcoin price drop.

For more on this trend, read Bitcoin Outlook: Tom Lee’s $200K Prediction.

3. Broader Market Risk-Off Sentiment

The Block reported that Bitcoin’s recent slide below $84,000 coincided with a sell-off in tech stocks and metals. This broader market weakness is another reason why the Bitcoin price is falling, as investors move away from risk assets. For a related overview of global market pressures affecting crypto, see Asian Stocks Drop Amid Rising Silver and Gold Prices.

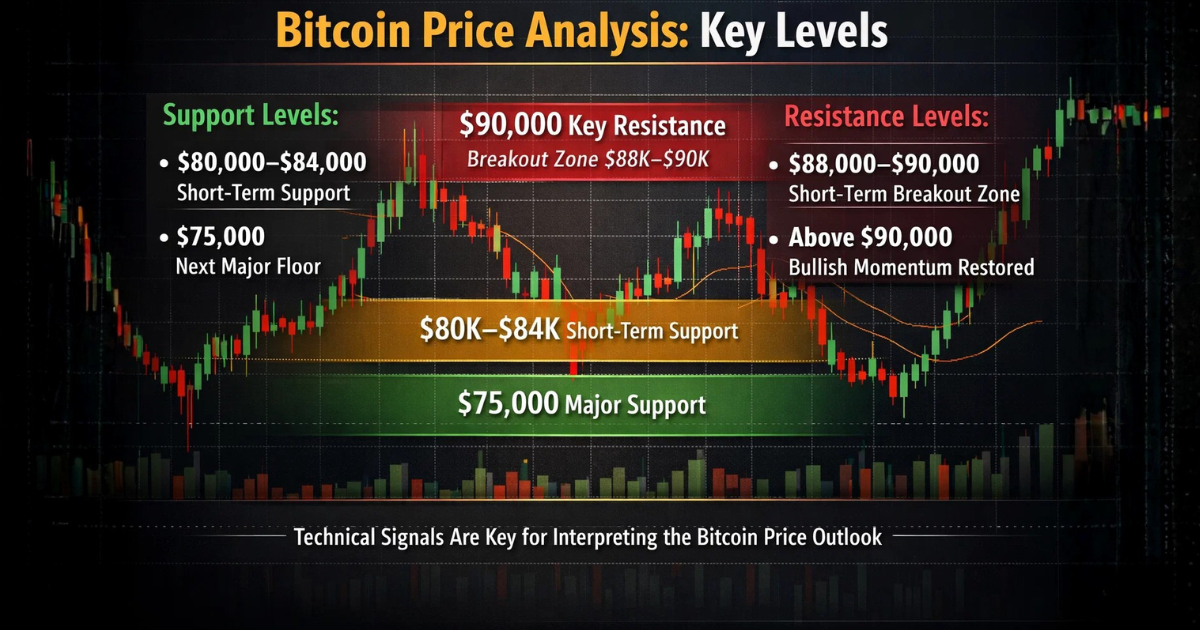

Bitcoin Price Analysis: Key Levels

Traders are monitoring critical support and resistance levels amid this Bitcoin price crash:

Support Levels:

- $80,000–$84,000, short-term support

- $75,000 — next major floor

Resistance Levels:

- $88,000–$90,000 — short-term breakout potential

- Sustained closes above $90,000 could restore bullish momentum

Technical signals are key to interpreting the Bitcoin price outlook and planning trades during volatile periods.

Bitcoin Price Outlook and Market Sentiment

Sentiment indicators show extreme fear in the market, reflecting the ongoing price of Bitcoin sell-off. Historically, these sentiment extremes sometimes align with market bottoms, creating potential opportunities for long-term holders.

For those monitoring the Bitcoin price today and anticipating future trends, also check Bitcoin Drops Below $92K Amid Tariff Fears.

Bitcoin Price Expectation Crash

The recent Bitcoin price drop reflects multiple converging factors:

- Accelerated price of Bitcoin liquidation

- Weakening institutional flows

- Risk-off sentiment in traditional markets

While short-term volatility remains high, the current pullback may present strategic opportunities for informed investors. Monitoring Bitcoin price analysis, technical support levels, and market sentiment will be essential for navigating this period of uncertainty.

For ongoing updates and in-depth insights into Bitcoin predicted price and broader crypto trends, stay tuned to FinanceCurves.

Marshall Mason is a senior market analyst at FinanceCurves.com, leading the finance news and trends category with expert coverage of crypto and financial markets. He tracks real-time market movements, price fluctuations, data-driven trends, and breaking updates across digital assets and global finance. With a strong analytical approach, Marshall translates complex market data into clear insights, helping readers understand market ups and downs, volatility patterns, and the forces shaping today’s crypto and financial landscapes.