U.S. stock index futures, including the Dow Jones Industrial Average, are trading higher as investors prepare for a week packed with market-moving events. The focus is on Big Tech earnings, key Federal Reserve policy decisions, and broader stock market trends.

For live Dow futures data, follow this Dow Jones futures quote on Yahoo Finance.

Technology Stocks Driving Pre-Market Gains

Pre-market trading shows technology stocks outperforming, giving the Dow, Nasdaq, and S&P 500 futures an early boost. Companies like Apple, Microsoft, and Meta are under the spotlight as traders anticipate their upcoming earnings.

Semiconductor and AI-focused companies are also leading gains. For example:

- Nvidia shows strong pre-market momentum due to AI demand.

- Intel and Micron Technology post notable gains, influencing broader tech sentiment.

For a detailed report, see this Reuters article on U.S. stock index futures.

Federal Reserve Announcement in Focus

Investors are closely monitoring the Federal Reserve’s upcoming policy guidance, which could influence Dow Jones futures today and broader stock market performance.

Most analysts expect the Fed to hold interest rates steady, but the language in the official statement could shift market expectations on inflation and economic growth.

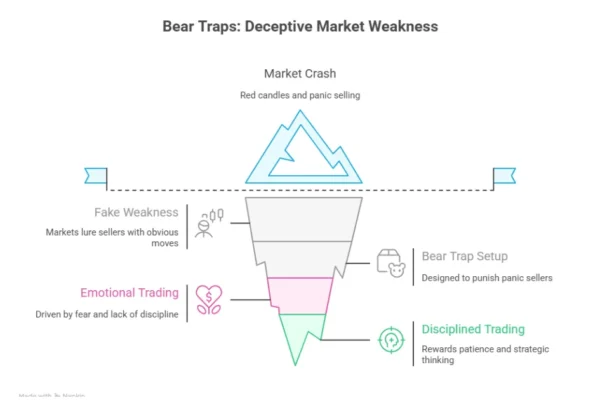

A neutral Fed stance may support equities, while hawkish signals could cause short-term market pullbacks, especially in interest-rate-sensitive sectors like financials and industrials. U.S. stock index futures, including the Dow Jones Industrial Average, are trading slightly higher as investors gear up for a critical week. For context on how the markets have been trending, check our previous update on U.S. stock futures declining earlier this week.

Sector Performance Shows Mixed Signals

While technology leads gains, sectors like healthcare and industrials show mixed pre-market performance. Healthcare faces regulatory and earnings pressures, and industrials adjust to global supply chain updates.

This divergence highlights the importance of tracking sector-specific trends along with broader indices like the Dow, Nasdaq, and S&P 500 futures. Analysts note that strong earnings from these tech giants could sustain market optimism, while any revenue or guidance misses could trigger short-term volatility. For a broader perspective on how technology and finance sectors have been leading market rebounds, see our Wall Street weekly wrap.

Analysts’ Key Focus Points This Week

- Big Tech Earnings:

Earnings from mega-cap tech firms could drive the stock market this week. Strong performance in cloud computing, AI, and software services may boost NASDAQ futures and influence the Dow Jones. - Federal Reserve Guidance:

Investors will watch the Fed’s commentary on inflation, GDP growth, and potential rate adjustments. Signals favoring lower rates could support equities, while hawkish language may lead to market caution. - Global Economic Factors:

International trade updates, geopolitical developments, and foreign market trends also impact U.S. stock market futures. For broader context, check this Reuters global market update.

Key Takeaways for Traders

- Dow Jones futures today are modestly higher ahead of Fed guidance and Big Tech earnings.

- Tech stocks are driving pre-market gains, especially AI and semiconductor companies.

- Sector divergence highlights uneven market strength across healthcare, industrials, and tech.

- Economic indicators and Fed signals will likely dictate market direction.

- Global factors continue to influence futures and investor sentiment.

Stay updated with real-time prices at Yahoo Finance Dow futures.

How to Track Dow and NASDAQ Futures for Smarter Trading Decisions

By monitoring Dow Jones futures, NASDAQ futures, Big Tech earnings, and the Federal Reserve’s policy guidance, traders can make informed decisions in a volatile market. While tech stocks are currently leading gains, mixed performance in other sectors and global developments suggest careful market analysis remains crucial.

Stay tuned to FinanceCurves for authentic news, actionable trading insights, and live updates from the U.S. stock markets.

Marshall Mason is a senior market analyst at FinanceCurves.com, leading the finance news and trends category with expert coverage of crypto and financial markets. He tracks real-time market movements, price fluctuations, data-driven trends, and breaking updates across digital assets and global finance. With a strong analytical approach, Marshall translates complex market data into clear insights, helping readers understand market ups and downs, volatility patterns, and the forces shaping today’s crypto and financial landscapes.