The Federal Reserve is expected to keep interest rates unchanged following its January 27–28, 2026, meeting, according to market forecasts and statements from policymakers. Investors and traders will be watching closely, but most signals point to a pause rather than a policy shift, keeping the US Federal Reserve target federal funds rate January 2026 at 3.50%–3.75%.

Markets are actively tracking the CME FedWatch January 2026 meeting date, which signals the timing of this pivotal event, and analyzing CME FedWatch target rate probabilities January 2026 meeting to gauge expectations. Current probabilities suggest a high likelihood of a hold, with many traders relying on the CME FedWatch probability January 2026 FOMC no change data. Investors can learn strategies for trading around Fed decisions in our best beginner guides to cryptocurrency trading 2026 to manage volatility while keeping portfolios safe.

December Cuts Set the Stage

The Fed’s last meeting in December 2025 was notable for three consecutive rate cuts, aimed at supporting a labor market that showed signs of slowing while addressing moderating inflation. While the cuts brought rates to their lowest levels in recent years, policymakers were cautious about moving too quickly.

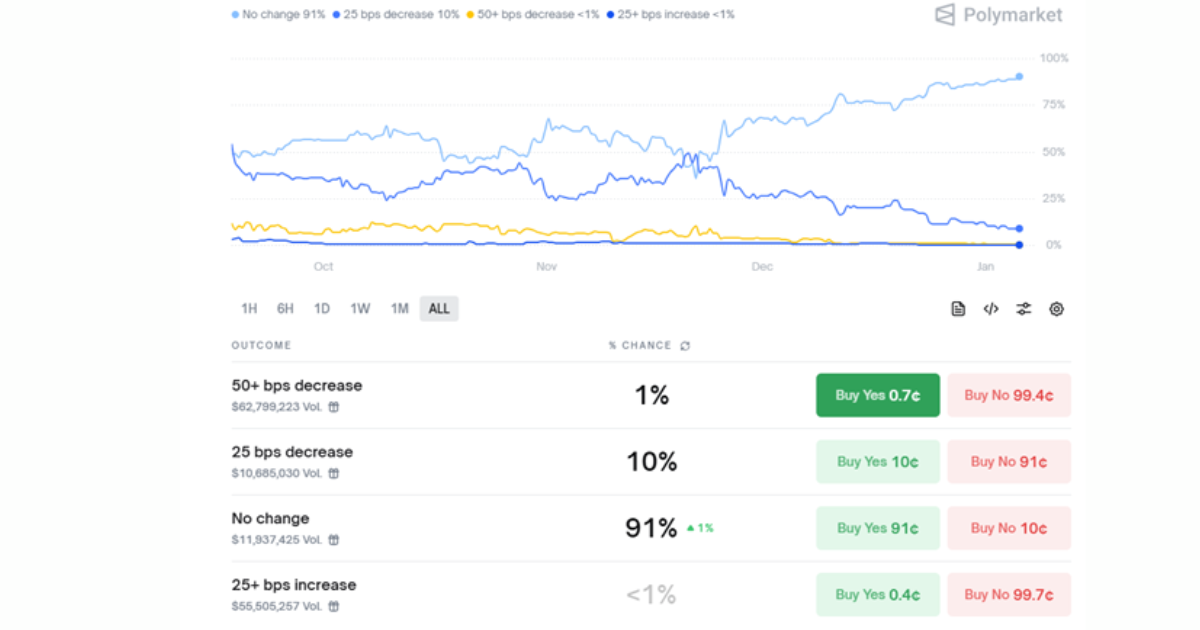

This backdrop sets the stage for January’s meeting: the Fed is likely to hold rates steady while monitoring incoming data on jobs, wages, and inflation. Markets have largely priced in a pause, with CME FedWatch January 2026 meeting probability hold 3.50–3.75 showing 84–91% that rates will remain unchanged.

Investors are also keeping an eye on the CME FedWatch January 2026 meeting probability no change, reflecting strong market confidence in a steady policy.

What Policymakers Are Saying

Fed officials have been clear that they want to assess more data before taking further action. Philadelphia Fed President Anna Paulson recently stated that there is room for cuts later in 2026 but emphasized caution in the near term. Other Fed members echoed that sentiment, noting that inflation is gradually moderating, and the labor market, while tight, is stabilizing.

Markets are paying attention to the CME FedWatch January 2026 FOMC meeting probability target rate, which fluctuates slightly based on incoming economic data and commentary. The upcoming Fed announcement upcoming news chatter potential unexpected move Fed January 2026 has analysts speculating about possible market volatility. Similarly, traders are monitoring the Fed announcement upcoming news chatter potential unexpected move Federal Reserve January 2026 to prepare for any surprises.

Credit: Ploymarket

Market Implications

Holding rates steady has several implications:

-

Borrowing Costs: Loans, mortgages, and credit card rates remain at current levels, affecting both consumers and businesses.

-

Financial Markets: Traders will likely shift focus to Fed commentary, economic projections, and the timing of possible future cuts later in 2026.

-

Investor Sentiment: Stability in rates can reduce immediate volatility, though markets remain sensitive to any unexpected signals on inflation or labor trends.

Many economists believe that future rate cuts are still possible later in 2026 if inflation continues to cool and economic growth slows. For January, the consensus is clear: a pause is expected.

Key Data to Watch

Even with no rate change expected, markets will watch key indicators leading up to and immediately following the Fed meeting:

-

-

Inflation Metrics: Core CPI and PCE readings for December, indicating whether price pressures are easing toward the Fed’s 2% target.

-

Employment Data: Job growth, unemployment rates, and wage trends, reflecting the labor market’s strength.

-

Economic Growth Signals: ISM reports, consumer spending, and factory orders that provide clues about the pace of the economy.

Monitoring these indicators alongside the CME FedWatch January 2026 meeting date and probability data helps investors position themselves effectively for 2026.

-

What This Means for Markets

The January 2026 Fed meeting is shaping up to be a steady, watchful pause rather than a bold policy shift. Investors should monitor the Fed’s commentary closely, as subtle language can move markets just as much as rate changes. With rates likely to remain at 3.50%–3.75%, attention is shifting to late 2026, when future cuts may come into play. For real-time updates, market analysis, and expert insights on the Fed and economic events, stay tuned to FinanceCurves, your guide to navigating the twists and turns of the financial world.