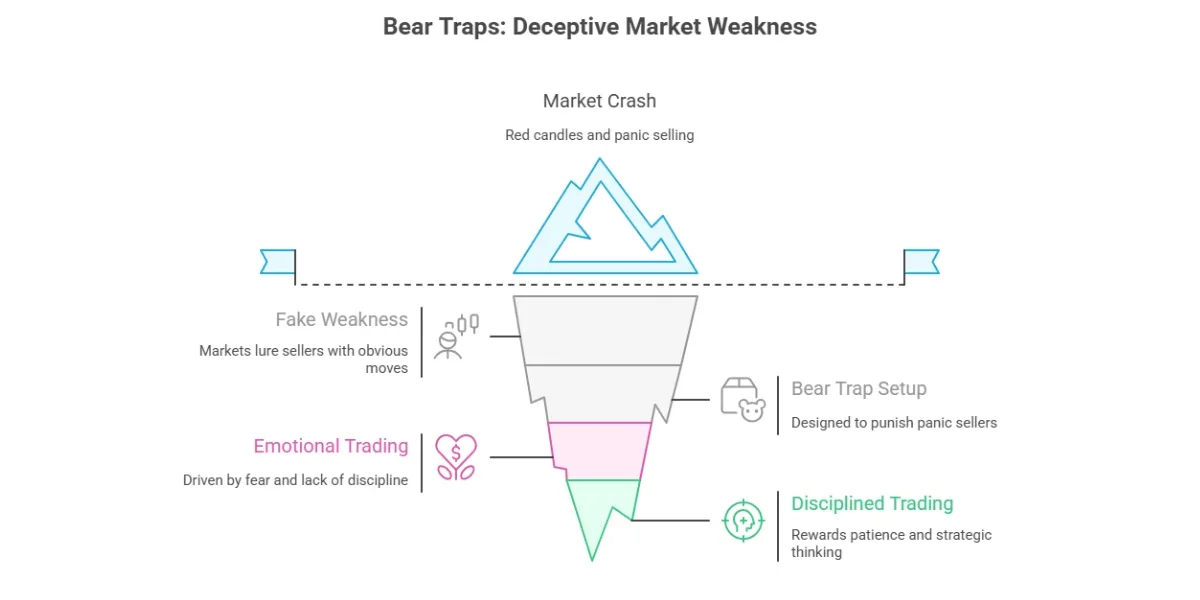

The market just “broke support.” Red candles stack up. Twitter screams crash. Traders rush to sell. But what if that drop is not real? In crypto, the most dangerous moves don’t look aggressive; they look obvious. Time and again, markets fake weakness, lure sellers in, and then reverse without warning. This isn’t a coincidence. It’s a setup.

Welcome to the bear trap, a market move designed to punish panic, reward patience, and transfer money from emotional traders to disciplined ones. If you’ve ever sold right before the price ripped higher, you’ve already met it.

At FinanceCurves, understanding bear traps in trading and how and why markets fake breakdowns isn’t just helpful; it’s survival.

What Is a Bear Trap? A Fake Breakdown That Costs Pain

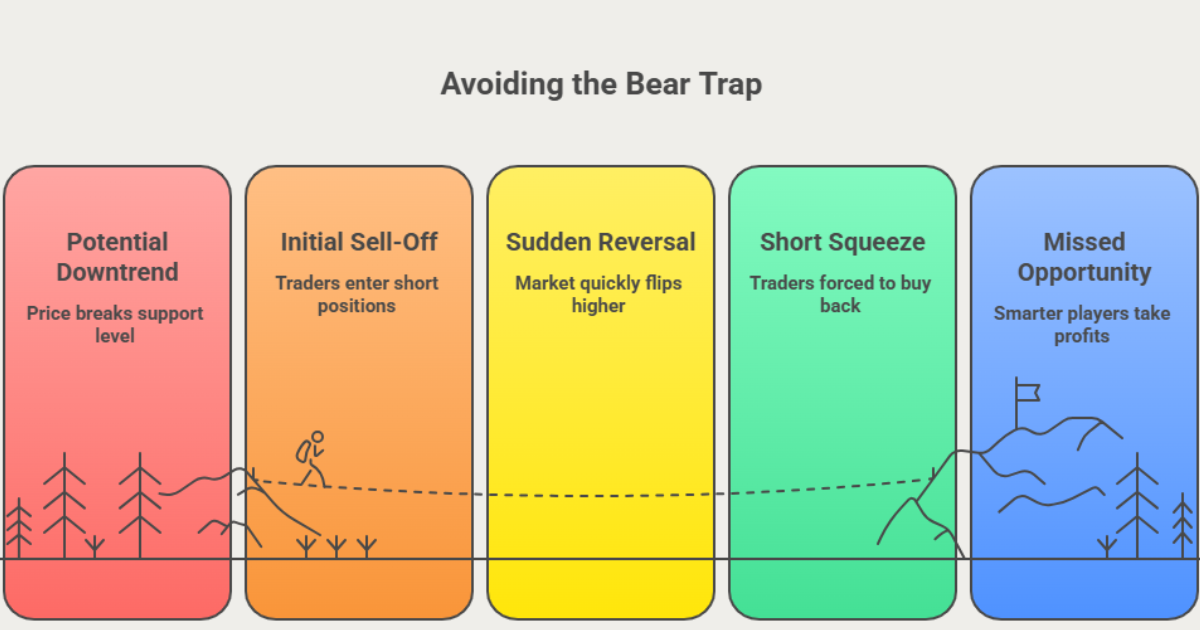

A bear trap happens when price action breaks below a key support level, convincing traders that a larger downtrend or bear market is starting. Sellers act, shorts get entered, and then the market suddenly flips higher.

Traders caught in this scenario get squeezed, forced to buy back at worse prices, often just as smarter players take profits.

In crypto lingo, you might also see it written as “bear trap” or referred to in discussions about major assets like BTC and ETH.

What is a bear trap in crypto? In simple words, the bear trap definition is a false breakdown below support that quickly reverses, trapping sellers and shorts.

Credit: Investopedia

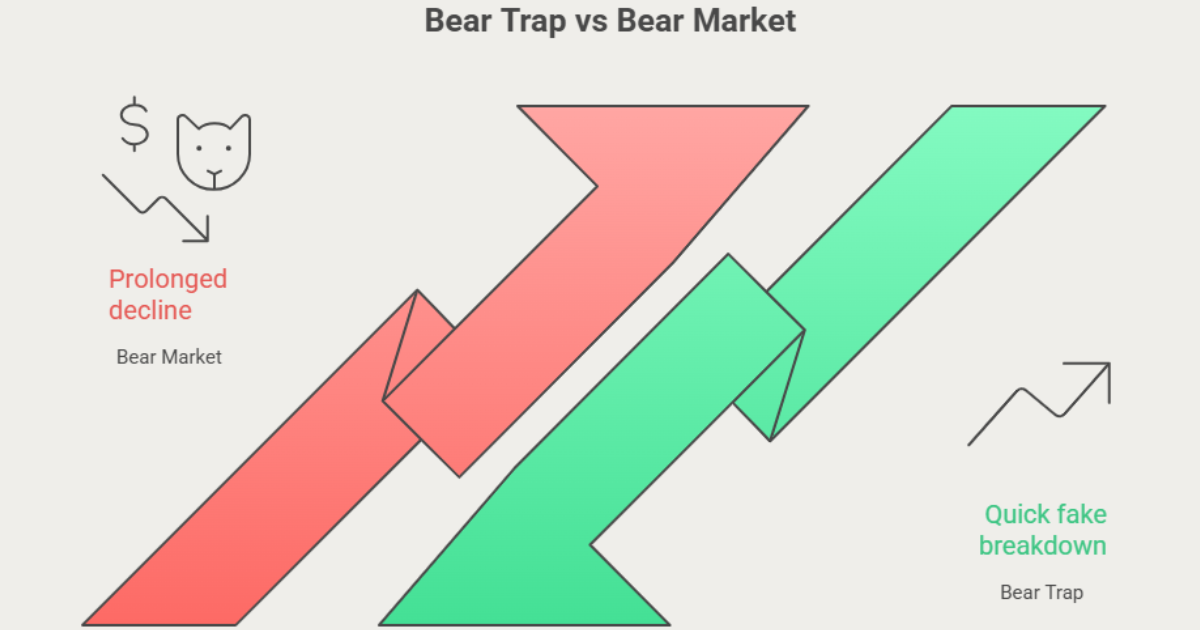

Bear Trap vs Bear Market: Understand the Difference

Misreading a bear trap for a bear market is one of the fastest ways to lose money.

Bear Market:

- Prolonged decline

- Lower highs & lower lows

- Macro and fundamentals drive price

Bear Trap:

- Quick fake breakdown

- Sudden reversal

- The price structure invalidates the drop

A bear trap is a short‑lived deception, not a structural trend change.

Are bear traps the same as bear markets?

No. A bear market is a long-term downtrend, while a bear trap is short-term and deceptive.

Live Crypto Examples: BTC & ETH Bear Trap Signals

Recent price behavior in major cryptos shows how bear traps play out in real markets:

Bitcoin (BTC)

At the end of December 2025:

- Bitcoin dipped near $87,331 amid thin year‑end volumes, creating fear across sentiment indicators.

- Just a day earlier, BTC rallied above $90,000, a classic example of quick rejection and recovery after a bearish wobble. For deeper context on how these moves affect price direction, see our latest Bitcoin price predictions.

Ethereum (ETH)

Ethereum similarly dropped toward the $2,900–$3,000 range but showed rapid rebounds when bulls stepped in.

These swings illustrate how markets test support with shallow drops before reversing, the very definition of a bear trap.

Can bear traps happen in Bitcoin or Ethereum?

Yes, BTC and ETH often show temporary dips that reverse sharply, classic bear trap behavior.

Credit: XS.com

Credit: XS.com

How a Bear Trap Forms — Step by Step

- Price approaches a known support levelX

- Fear or bad news increases selling pressure

- Support breaks slightly (e.g., 1–4%)

- Volume on breakdown remains weak

- Sellers flood in

- Price quickly reclaims support

- Traders are squeezed into losses

Bear traps feed on panic, not profound bearish conviction.

Visual Guide: Bear Trap Price Structure

Price

│

│ ┌───── Reversal

│ /│

│ / │

│_____/__│______ Support

│ ↓ Fake Breakdown

│

└──────────────── Time

Bull Traps vs Bear Traps: Spot the Difference

| Trap Type | Fake Signal | Who Gets Burned |

| Bear Trap | Breakdown | Sellers & Shorts |

| Bull Trap | Breakout | Buyers & Longs |

Bear trap vs. bull trap, both are immersive features of a trap market, where emotional traders often get caught.

Bear Trap Season Is Open — Are You the Prey or the Hunter?

This is where traders separate themselves.

In a trap market, someone must lose for someone else to win. When fear peaks and selling feels “safe,” that’s often when professional traders step in.

Bear traps exist because:

- Retail traders act emotionally

- Institutions act patiently

- Markets reward discipline

The question isn’t if bear traps happen.

It’s who they trap.

Bear Trap Trading Strategies (Rated by Risk) Can traders profit from bear traps?

| Strategy | Risk Level | Success Potential |

| Sell on the first breakdown | Very High | Low |

| Buy break (no confirmation) | High | Low |

| Wait for the retest, then trade | Medium | Medium |

| Buy a confirmed reversal on support | Lower | Higher |

Rule of thumb: Don’t trade the first move — trade the confirmation.

Yes, by buying confirmed reversals or selling into weak breakdowns with proper risk control. As traders adapt to trap-driven markets, our crypto exchange guides break down which platforms, fees, and tools suit different strategies.

Credit: XS.com

Bear Trading vs. Bear Trap: Key Difference

Bear trading reflects a real structural downtrend. Bear traps lure premature sellers with fake breakdowns. In crypto, bear traders must confirm trend continuation before entering shorts; otherwise, they’re bait for liquidity collectors. Plus, advanced traders often use confirmation tools discussed in our DeFi & derivative trading section to avoid premature entries

Psychology: Why Traders Fall for Bear Traps

Markets prey on:

- Fear of loss

- Herd behavior

- Headlines and social media noise

- Overreliance on single indicators

Emotional trading feeds traps; disciplined logic avoids them. You must be thinking, “How can I avoid getting caught in a bear trap?” Wait for confirmation of support reclamation, monitor volume, and avoid panic selling.

Credit: XS.com

Key Signs You’re Watching a Bear Trap

- Weak Volume on Breakdown

If price breaks support but volume doesn’t increase, sellers lack conviction.

- Fast Recovery Above Support

A quick reclaim is one of the strongest beartrap signals.

- Long Lower Wicks

Buyers are absorbing selling pressure.

- RSI Holds Above 40

Momentum isn’t truly bearish.

- Heavy Short Interest

Crowded shorts often fuel reversals.

How Pros Avoid Bear Traps

Seasoned traders:

Use multi-timeframe confirmation

Trade smaller sizes in traps.

Accept missed trades

Protect risk before seeking profit

Professionals don’t chase; they validate before entry.

What Happens After a Bear Trap? Market Behavior

After a typical trap:

- Price often rallies to reclaim highs

- Volume expands as long as it is activated.

- Shorts get liquidated, accelerating up moves

In crypto, this pattern repeats often due to high leverage and retail crowd psychology.

Survive the Trap Market

A bear trap isn’t a mistake; it’s a market behavior pattern designed to exploit fear and create liquidity.

If you learn to:

- Spot fake breakdowns early

- Differentiate between trend and trap

- Confirm moves with structure and volume

- Manage risk aggressively

You stop being the prey and start trading like the hunter.

Markets don’t punish being wrong. They punish being early and emotional.

For more insights and info, head to FinanceCurves.

FAQs

What causes a bear trap in crypto markets?

Bear traps are often caused by low liquidity, panic selling, and large players testing support levels.

Is trading a bear trap riskier than normal trading?

Yes, because traps lure traders into positions prematurely, increasing the chance of losses.

Can automated bots fall for bear traps?

Absolutely. Bots that follow price breaks without confirmation often trigger stop losses in traps.

Do all cryptocurrencies experience bear traps?

Most liquid assets like BTC, ETH, and major altcoins experience them. Yet, smaller coins can be more erratic.

How long does a typical bear trap last?

This can last anywhere from a few hours to a few days, depending on market liquidity and volatility.

Can news or social media trigger bear traps?

Yes. Fake breakdowns and panic selling are frequently accelerated by frightening headlines or rumors.

Should beginners try to trade bear traps?

It is not advised. Chasing traps, beginners should concentrate on risk management and confirmations.

Marshall Mason is a senior market analyst at FinanceCurves.com, leading the finance news and trends category with expert coverage of crypto and financial markets. He tracks real-time market movements, price fluctuations, data-driven trends, and breaking updates across digital assets and global finance. With a strong analytical approach, Marshall translates complex market data into clear insights, helping readers understand market ups and downs, volatility patterns, and the forces shaping today’s crypto and financial landscapes.