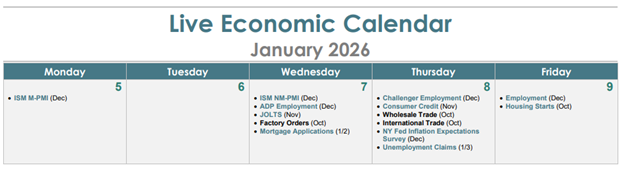

This week’s economic calendar is packed with market‑moving events that investors cannot ignore. From jobs data to inflation signals and Fed speeches, every release has the potential to push stocks, bonds, and the U.S. dollar. Knowing what’s coming can give you an edge in planning positions and managing risks.

What’s on the 2026 Calendar

1. December Jobs Report (Friday) — Big Influence on Markets

The highlight of the week is the U.S. jobs report, which includes nonfarm payrolls, unemployment rate, and wage data. Markets hate surprises, and this report regularly moves stocks and bond yields. Traders are monitoring:

-

Forecast: Solid job growth expected as the labor market remains tight.

-

Key Metrics: Nonfarm payrolls + unemployment rate + average hourly earnings.

These stats indicate consumer spending power and Fed policy direction. A stronger-than-expected jobs number could push Treasury yields up and equities down, while weaker figures might lift stocks and cut bond yields.

2. Fed Speakers All Week — Markets Listen Closely

Federal Reserve officials are scheduled to speak multiple times this week. Every nuance from these speeches can alter expectations for interest rates and monetary policy because the central bank is still navigating inflation and growth trends. Last month, news of Yahoo Finance clearly showed that markets have been sensitive to Fed comments since last year’s rate cuts.

3. Inflation Signals & ISM Data: Price Pressures in Focus

Inflation remains a top priority for investors, especially those following robthecoins business tips to stay ahead of market shifts. Among the key releases this week are closely watched indicators that reveal where price pressures may be heading.

ISM Manufacturing PMI: A reading under 50 signals contraction in manufacturing activity, which can weaken investor confidence and impact market sentiment across equities, bonds, and currencies.

Services PMI: This report reflects strength in the broader economy, particularly in consumer-driven sectors. Since services make up a large portion of economic activity, strong or weak data here often reshapes inflation rate expectations.

Together, these indicators provide deeper insight into inflation and economic momentum beyond headline CPI numbers. For traders and investors using robthecoins business tips on inflation and markets surprises in ISM data can quickly influence rate expectations, central bank outlooks, and short-term market positioning.

4. JOLTs Job Openings & Factory Orders — Insight Into Labor and Production

The JOLTs report on job openings and the factory orders release give insight into labor demand and business activity:

-

JOLTs Job Openings: Provides data on how many positions are available, showing labor market demand.

-

Factory Orders: Measures changes in business demand.

These metrics matter because strong demand can prolong inflation, while weakness may signal slowing growth.

Quick Stats to Watch This Week

Here are some numbers and forecasts worth bookmarking:

-

The unemployment rate, according to Investing.com expected near historic lows (≈4.1–4.3%).

-

Wage Growth: Average hourly earnings forecasts provide clues about consumer spending.

-

ISM Manufacturing PMI Dec (Forecast ~48.2): Roughly below 50 = contraction.

-

JOLTs Job Openings: Measuring labor demand trends.

What This Means for Investors

This week’s calendar highlights continued market caution and heightened volatility potential. Here’s how each event could influence markets:

- Jobs data — A bellwether for consumer strength and spending.

- Fed speeches — Can sway risk assets depending on rate outlook.

- Inflation gauges — Help predict Fed’s policy path.

- Labor & production data — Offer early clues about economic expansion or slowdown.

Markets are forward‑looking, so traders will be pricing in expectations before the actual data drops — meaning the first reaction often comes ahead of the release, and the second reaction on the release itself.

Stay Prepared This Week

With major data lined up, including jobs, inflation, and central bank cues, volatility could rise sharply. Investors should keep an eye on these releases, as they have historically moved markets and rate expectations. For real‑time updates, expert breakdowns, and strategic insights on economic events, stay withFinanceCurves. We’ll help you understand not just what’s happening, but why it matters for your portfolio.